Now that’s a wrap! And just like that, another year goes by. Don’t we always find ourselves saying – – time is just flying by? But in this case, and if I’m being honest, as many of you probably can relate … Good riddance to 2023… and hello 2024!! I am a “glass half full” type of person, so I am going into 2024 being cautiously optimistic.

If you are thinking of buying or selling a home soon, you probably will want to know what to expect from the housing market in 2024. Well, if I had that crystal ball that everyone talks about – I’d be able to tell you for certain, but from what the experts are saying we have turned a corner to a better market ahead going into 2024. We already have seen interest rates come down a bit, and it is predicted that they will continue to do so. But still and all, with the lack of inventory we continue to find the housing market a bit challenging for both buyers and sellers.

Mortgage Rates Expected To Ease

Recently, mortgage rates have started to come back down. This has offered hope to buyers dealing with affordability challenges, taking them off the sidelines and back into the game. Mortgage rates have already come down in some areas of upwards of a full percentage point or more from the recent peaks of up near 8%, which are still predicted to come down even further, providing the Fed’s own projections hold true as they battle with inflation. But might I just add, that if you are thinking/hoping that rates will come back down to the unprecedented rates they were before the hikes of 2%-3% – I think those days are long gone. Just saying …. But then again, I’m a glass half full type of person, so you never know – but that’s the word I’m hearing around town

The outlook for the housing market in 2024 is bright dependent on the path of inflation and the health of the economy. The Feds own projections indicate that their battle with inflation could end soon, which may very well mean we should not see any more interest rate hikes.

Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says …

“For home buyers who are taking on a mortgage to purchase a home and have been wary of the autumn rise in mortgage rates, the market is turning more favorable, and there should be optimism entering 2024 for a better market.”

The Supply of Homes For Sale May Grow

As rates come down, activity in the market should pick up no doubt, as both buyers and sellers were holding off to see how the market plays out – may soon find themselves “back in the game” as more sellers will list their properties which will loosen up inventory, giving buyers more choices, and allows sellers to move on to making their plans, as for some sellers that may have felt “locked in” to their low rate will now feel a bit more comfortable about making their move, as their family dynamics and financial circumstances change, and particularly if rates move closer to 6.5%.

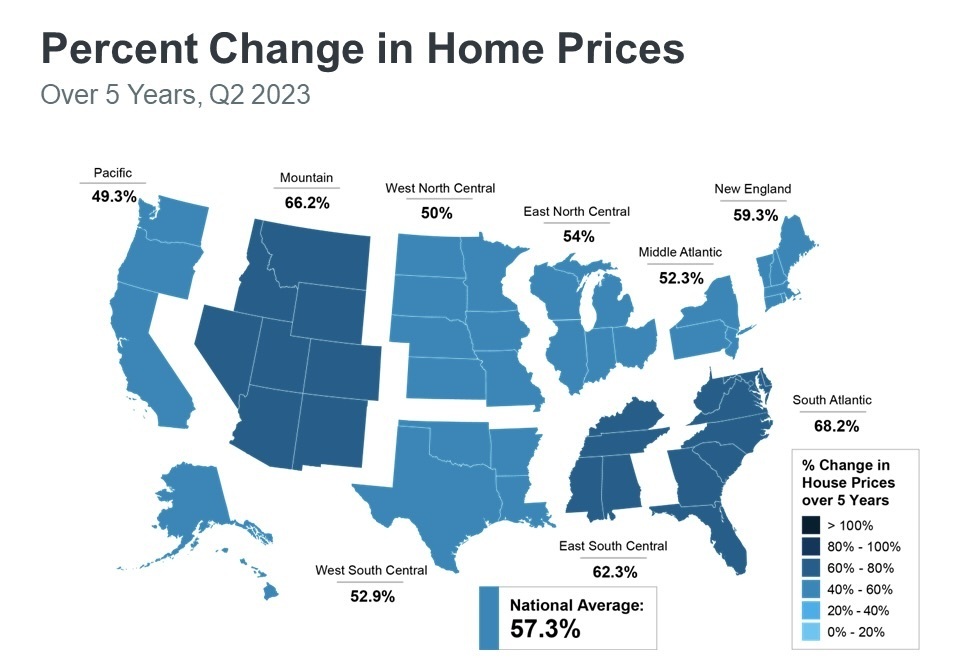

Home Price Growth Should Moderate

Important to note …

Mortgage rates pulling back isn’t the only positive sign for affordability, home price growth is expected to moderate as well as inventory improves, but for now still low overall. As the Home Price Expectation Survey (HPES) from Fannie Mae, a survey of over 100 economists, investment strategists, and housing market analysts, say …

“On average, the panel anticipates home price growth to clock in at 5.9% in 2023, to be followed by slower growth in 2024 and 2025 of 2.4 percent and 2.7 percent, respectively.”

To wrap it up … experts project 2024 will be a better year for the housing market. So, if you’re thinking about making a move in 2024, know that early signs show we’re turning a corner.

We’re going into 2024 with slight home-price gains, somewhat easing inventory constraints, and slightly increasing sales volume . . . All in all, things are looking up for the housing market in 2024.

I would like to close by saying this …

Thank you all so much for entrusting me with the opportunity to assist you with one of the biggest decisions you will make in your lifetime. It has truly been my honor and my pleasure to have been part of your journey and for that I am truly grateful.

Should you, or any of your friends or family be thinking about buying or selling a home, I hope you will think of me as that “go to real estate professional.” Or perhaps you may just need some good sound real estate advice to help in the decision-making process … in either of these cases, please do not hesitate to reach out to me. I am here, and happy to help!

Here’s looking forward to a brighter more prosperous New Year. All the best in 2024!

Laura Cruger